The RARE Advisor: How Annuities Buy Time for AUM

Comprehensive financial advisors are selling and working with more annuities than ever before. It’s a staging asset and it frees up the opportunity to gather up all the assets under management. We’ll dive deeper into how this opportunity can benefit you and, more importantly, your clients in this episode of The RARE Advisor.

Many advisors have never heard of staging assets, which are kind of a step between your commissionable (your transactional) type of transactions versus your AUM (your recurring revenue) type of transactions. What these staging assets or staging transactions really do is sometimes provide you with true recurring revenue depending upon the vehicle that you use. But more importantly, they stage you to get all of the AUM, all of the rest of the portfolio, that therefore generates recurring revenue.

Here's the deal: fixed index annuities can be perfectly married together as staging assets. So if you are operating on the 4% rule (where you're just peeling off 4% from the top of the bucket of assets, with the idea that interest, dividends, growth, and so on will support that) or if you're living/managing off the 4% rule, this will help you. If you are operating with bond portfolios, and doing the 60/40 and various other things, I think this will also help you. The fixed index annuities, however, are really there, in this particular instance, to drive the income during retirement.

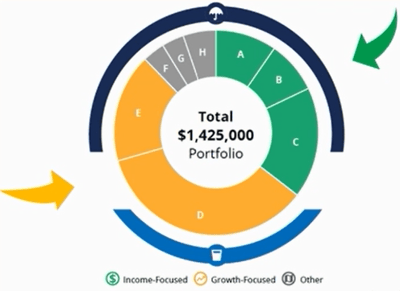

Now, here what we're showing is a view from the Asset Cycle Portfolio System, just one small graphic that we use inside of that system. What we're doing is this first account right up here in the top, labeled as A, is there to provide the first five years of retirement income. Let's assume these people are five years away from retirement right now. That first account, we're going to stage it right now. So it is going to sit in deferral for five years, and then five years from now they're going to trigger out five years worth of income, and it's going to pull those first five years of retirement income. Then, account B is going to pull the second five years of retirement income. So net, that will be a total of 10 years between those two. And it's starting five years in the future. So essentially, we're now 15 years into the future, right? So five years deferral, five years income, another five years income, and then account C - that's going to take them through the next subsequent 10 years of retirement income. So now I've got a total of 20 years of income spanned over 25 years from the moment I met them, because I'm assuming they're five years away from retirement.

Now, here what we're showing is a view from the Asset Cycle Portfolio System, just one small graphic that we use inside of that system. What we're doing is this first account right up here in the top, labeled as A, is there to provide the first five years of retirement income. Let's assume these people are five years away from retirement right now. That first account, we're going to stage it right now. So it is going to sit in deferral for five years, and then five years from now they're going to trigger out five years worth of income, and it's going to pull those first five years of retirement income. Then, account B is going to pull the second five years of retirement income. So net, that will be a total of 10 years between those two. And it's starting five years in the future. So essentially, we're now 15 years into the future, right? So five years deferral, five years income, another five years income, and then account C - that's going to take them through the next subsequent 10 years of retirement income. So now I've got a total of 20 years of income spanned over 25 years from the moment I met them, because I'm assuming they're five years away from retirement.

So, I'm simply taking a portion of the portfolio and designating it up front with these staging assets (staging for their ultimate retirement income). I like to use guaranteed vehicles - that's why I prefer the fixed indexed annuities, because I want to lock in and know exactly what's happening there. I've just given myself, in this example, 25 years as a financial advisor, to then take over all the rest of their equity portfolio. Now, if I can't make that thing stand up and sing over a 25-year period, I've got some real problems. But what I've done both for me and for the investor is, I have essentially put time on their side.

Just to give you a quick example from the S&P 500: this chart is about a 26 year span, from 1997 through 2023. And the red vertical lines indicate 10 year blocks. Now, if you give me 25 years as a financial advisor, I pretty much can't help but win. Now, if you block that down, like in the 'Lost Decade' - if somebody retired at the beginning of that decade, and then they came to you right at the end of that decade and needed to draw income, that's a tough conversation. This is why we like risk managed vehicles, because we can flatten out some of these troughs. And we can try to essentially eliminate that lost decade that's taken place.

Just to give you a quick example from the S&P 500: this chart is about a 26 year span, from 1997 through 2023. And the red vertical lines indicate 10 year blocks. Now, if you give me 25 years as a financial advisor, I pretty much can't help but win. Now, if you block that down, like in the 'Lost Decade' - if somebody retired at the beginning of that decade, and then they came to you right at the end of that decade and needed to draw income, that's a tough conversation. This is why we like risk managed vehicles, because we can flatten out some of these troughs. And we can try to essentially eliminate that lost decade that's taken place.

But, if I've got 25 years of time, you can't find a period of time in the history of the stock market that you would not look good over a 25-year period. So, buying time to get the rest of the portfolio and then investing it wisely and accordingly for long-term growth... I can only do that if I start first with staging assets. And personally, I would recommend using fixed index annuities for that section A, B, and C in the chart above.

Now, if you're interested, we have a new, free report called the 'Advisor's 12-Step Reset for Predictable Growth, Value & Lifestyle'. It's a smooth, 12-step process that I've uncovered and discovered over my 35+ year journey in this industry. And it's designed to generate a predictable practice with automated revenue and lifetime rewards.

--

The RARE Advisor is a business model supercharged by Recurring And Repeatable Events. With more than thirty years of working with and coaching successful advisors, host Mike Walters (along with other leaders in the industry), discusses what it takes to grow a successful practice. With the aim of helping financial professionals and financial advisors take their business to the next level, Mike Walters shares insights and success stories that make a real impact. Regardless of the stage of your practice, The RARE Advisor will provide thoughtful guidance, suggestions for developing systems and processes that work, and ideas for creating an authentic experience for your clients.

The RARE Advisor is also a podcast! Subscribe today via Apple Podcasts, Google Podcasts, or your preferred podcast listening service for easier on-the-go listenin

Author Info

Mike Walters is the Chief Executive Officer (CEO) of USA Financial, leading the firm since its inception in 1988. Mike is committed to...

Related Posts

How Advisors Can Get 10 Hours Back Every Week

In this episode of The RARE Advisor, host Aaron Grady and USA Financial Pareto coach and Practice Management Consultant Allan Oehrlein dive into time allocation as a core lever for advisory success. They unpack the biggest time drains—email, unsolicited calls, and open-door interruptions—and lay out a practical framework for calendar rebalancing that starts with personal time, management time, client appointments, dedicated communications windows, “work on the business” time, and high-impact growth activities. With real-world stories showing how advisors shift from reactive days to structured weeks (and even reclaim Fridays), Aaron and Allan share easy-to-implement tips: color coding calendars, scheduling buffers, daily huddles, and call/appointment protocols. If you’re ready to audit your calendar, define your ideal week, and create structure that truly liberates your practice, this conversation is your next step.

What Billion-Dollar Brands Teach Advisors About Client Loyalty

In this episode of the Financial Advisor Marketing Playbook, Mark Mersman explores what billion-dollar consumer brands like Peloton, Apple, Airbnb, Disney, and Starbucks understand about loyalty—and how financial advisors can apply these lessons to their own practices. Discover why loyalty is emotional, not transactional, and learn practical strategies to create belonging, simplify your process, showcase identity, design unforgettable experiences, and personalize client interactions. Tune in to transform your value proposition and build a community your clients never want to leave.

Continuity Plans vs. Succession Plans: Why Every Advisory Practice Needs Both

What’s the difference between a continuity plan and a succession plan—and why does your advisory practice need both? In this episode of The Rare Advisor, Aaron Grady breaks down these two essential strategies, explains how they protect your firm from unexpected events and prepare you for long-term success, and shares practical steps to start building or improving your plans. If you want to safeguard your business, elevate your professionalism, and protect your legacy, this episode is a must-watch.

How Advisors Can Get 10 Hours Back Every Week

In this episode of The RARE Advisor, host Aaron Grady and USA Financial Pareto coach and Practice Management Consultant Allan Oehrlein dive into time allocation as a core lever for advisory success. They unpack the biggest time drains—email, unsolicited calls, and open-door interruptions—and lay out a practical framework for calendar rebalancing that starts with personal time, management time, client appointments, dedicated communications windows, “work on the business” time, and high-impact growth activities. With real-world stories showing how advisors shift from reactive days to structured weeks (and even reclaim Fridays), Aaron and Allan share easy-to-implement tips: color coding calendars, scheduling buffers, daily huddles, and call/appointment protocols. If you’re ready to audit your calendar, define your ideal week, and create structure that truly liberates your practice, this conversation is your next step.

What Billion-Dollar Brands Teach Advisors About Client Loyalty

In this episode of the Financial Advisor Marketing Playbook, Mark Mersman explores what billion-dollar consumer brands like Peloton, Apple, Airbnb, Disney, and Starbucks understand about loyalty—and how financial advisors can apply these lessons to their own practices. Discover why loyalty is emotional, not transactional, and learn practical strategies to create belonging, simplify your process, showcase identity, design unforgettable experiences, and personalize client interactions. Tune in to transform your value proposition and build a community your clients never want to leave.

Continuity Plans vs. Succession Plans: Why Every Advisory Practice Needs Both

What’s the difference between a continuity plan and a succession plan—and why does your advisory practice need both? In this episode of The Rare Advisor, Aaron Grady breaks down these two essential strategies, explains how they protect your firm from unexpected events and prepare you for long-term success, and shares practical steps to start building or improving your plans. If you want to safeguard your business, elevate your professionalism, and protect your legacy, this episode is a must-watch.