The RARE Advisor: Gather Entire Portfolio of Assets with One Graphic

In this episode of The RARE Advisor, I want to jump into a basic – but unbelievably important – concept for clients and investors to understand the financial plan you’re presenting to them. And, more importantly, to get them to truly see the benefit of transitioning/adjusting their portfolio and moving and onboarding to you and your practice.

It really boils down to a before and after picture. You've seen this anywhere and anytime there's any kind of a weight loss pitch taking place. There's always the before and after picture. And the "why" is because it works. It's probably the number one thing that does work for those scenarios. Your scenario is actually quite similar because when clients are coming to you, generally speaking, their financial plan (their portfolio) is in disarray. And you are going to pull it all back together, make it healthy again, and kind of repackage it and provide that back to them in a much better format than how you first found it. So it's very important that you have a before and after opportunity to have a conversation with a client to get them to understand what's going on inside their plan.

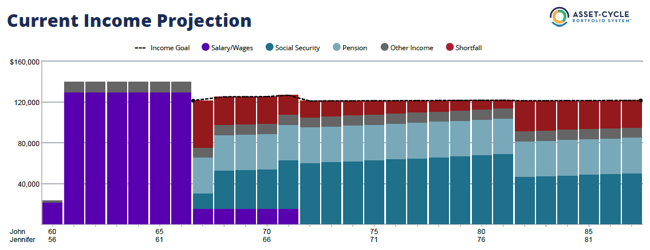

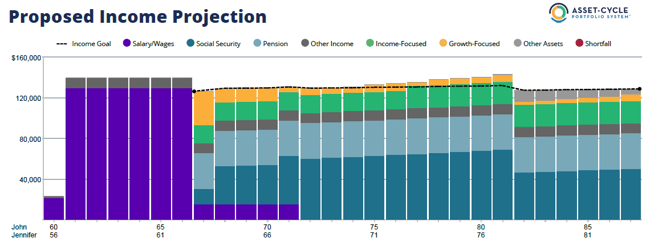

We have pioneered something called the Asset Cycle Portfolio System. It has been around for decades, and many moons ago was turned into a unbelievably effective software package. It's simple, it's profound, but it has multiple pages of backup material. And two of the pictorials that I really like to see as a reference piece are the 'Current Income Projection' - essentially the before picture of their portfolio - and then the 'Proposed Income Projection' - essentially the after picture of their portfolio.

In the example above - using John and Jennifer - we use red to identify the shortfall. During the purple periods of time, that's their salary and wages. So essentially, they're going to retire in five years. But, the way their current plan is set up with their current assets, they're coming in with all of this shortfall that you have an opportunity to fix as a financial advisor. And this is an actual case. This had, I believe, just about one and a half million dollars in total in the portfolio. And by making changes (I'm not going to bore you with all the specific changes), you'll notice there is no more red, there's no more shortfall. We've got a bunch of income-focused pieces (in green) that have replaced that shortfall. And you can see all the others as well. But everything else during their working years is basically the same. We've just adjusted what's going on in their portfolio to truly create a before and after scenario.

And now you can lay these side-by-side and people can truly understand what the ramifications are of what it is that you're discussing.

Now, if you're interested, we have a new, free report called the 'Advisor's 12-Step Reset for Predictable Growth, Value & Lifestyle'. It's a smooth, 12-step process that I've uncovered and discovered over my 35+ year journey in this industry. And it's designed to generate a predictable practice with automated revenue and lifetime rewards.

--

The RARE Advisor is a business model supercharged by Recurring And Repeatable Events. With more than thirty years of working with and coaching successful advisors, host Mike Walters (along with other leaders in the industry), discusses what it takes to grow a successful practice. With the aim of helping financial professionals and financial advisors take their business to the next level, Mike Walters shares insights and success stories that make a real impact. Regardless of the stage of your practice, The RARE Advisor will provide thoughtful guidance, suggestions for developing systems and processes that work, and ideas for creating an authentic experience for your clients.

The RARE Advisor is also a podcast! Subscribe today via Apple Podcasts, Google Podcasts, or your preferred podcast listening service for easier on-the-go listening

Author Info

Mike Walters is the Chief Executive Officer (CEO) of USA Financial, leading the firm since its inception in 1988. Mike is committed to...

Related Posts

Why Good Hires Fail: Common Mistakes in Hiring a Junior Advisor

For you, bringing on a junior—or “NextGen” advisor—may be a strategic move, not only for capacity-building but also as a key step in building enterprise value, elevating the client experience, and advancing succession planning. Yet despite careful hiring, promising talent, and good intentions, many of these partnerships flounder. The hire doesn't “stick.” The vision for a seamless transition begins to unravel.

How AI is Transforming Advisor-Client Relationships & Document Security

Discover the concept of "Advisor 3.0," the importance of offering comprehensive services beyond investments, and how tools like Future Vault can strengthen client relationships, facilitate wealth transfer to the next generation, and ultimately enhance the value advisors provide.

Why Top Advisors Use Client Surge Meetings

Tired of the scheduling chaos? Imagine a world with less burnout, more client focus, and actual time for growth. Intrigued? In this episode of The RARE Advisor, we’ll break down how client surge meetings can maximize efficiency and reclaim your calendar. Discover the unexpected benefits and practical tips that could transform your client relationships and your work-life balance.

Why Good Hires Fail: Common Mistakes in Hiring a Junior Advisor

For you, bringing on a junior—or “NextGen” advisor—may be a strategic move, not only for capacity-building but also as a key step in building enterprise value, elevating the client experience, and advancing succession planning. Yet despite careful hiring, promising talent, and good intentions, many of these partnerships flounder. The hire doesn't “stick.” The vision for a seamless transition begins to unravel.

How AI is Transforming Advisor-Client Relationships & Document Security

Discover the concept of "Advisor 3.0," the importance of offering comprehensive services beyond investments, and how tools like Future Vault can strengthen client relationships, facilitate wealth transfer to the next generation, and ultimately enhance the value advisors provide.

Why Top Advisors Use Client Surge Meetings

Tired of the scheduling chaos? Imagine a world with less burnout, more client focus, and actual time for growth. Intrigued? In this episode of The RARE Advisor, we’ll break down how client surge meetings can maximize efficiency and reclaim your calendar. Discover the unexpected benefits and practical tips that could transform your client relationships and your work-life balance.