The RARE Advisor: The NEW $8.8 Trillion Opportunity

There’s a little-known opportunity taking place in the markets right now, with $8.8 trillion ready to invest at record-breaking levels. In this episode of The RARE Advisor, we’ll share why this is something you need to be aware of, and why you’ll want to take advantage of it.

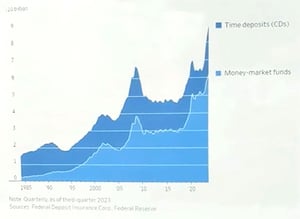

Today, I want to point out an $8.8 trillion opportunity for you in your practice. As you may be aware, interest rates jumped up as of late, they've been kind of holding in, and they are potentially going to be declining here again in the near future. But that spike up made a flood of clients/investors pull money out of the markets, and push money into money markets and CDs. And as the Wall Street Journal reported, at the end of 2023, there was $8.8 trillion in CDs and money markets. This is unheard of, you don't see that kind of money going into those vehicles, especially in the rapid sense in which it did.

So this is a graphic from that same article. Look at the spike on the far right - that is recent times. And that is the spike up that took place in money markets and CDs. Money markets is the light blue and then they tack on the CDs and you're up to $8.8 trillion. That is a lot of what is referred to on Wall Street as as "dry powder". That money is getting antsy, that money is going to get invested back into the markets. It's just a matter of who's going to help the investors do that.

May I suggest it should be you.

--

The RARE Advisor is a business model supercharged by Recurring And Repeatable Events. With more than thirty years of working with and coaching successful advisors, host Mike Walters (along with other leaders in the industry), discusses what it takes to grow a successful practice. With the aim of helping financial professionals and financial advisors take their business to the next level, Mike Walters shares insights and success stories that make a real impact. Regardless of the stage of your practice, The RARE Advisor will provide thoughtful guidance, suggestions for developing systems and processes that work, and ideas for creating an authentic experience for your clients.

The RARE Advisor is also a podcast! Subscribe today via Apple Podcasts, Google Podcasts, or your preferred podcast listening service for easier on-the-go listening.

Author Info

Mike Walters is the Chief Executive Officer (CEO) of USA Financial, leading the firm since its inception in 1988. Mike is committed to...

Related Posts

The Psychology Behind Your CTA: Why Prospects Don’t Click “Book a Call”

In this episode of Financial Advisor Marketing Playbook, Mark Mersman breaks down the real psychological barriers that stop prospects from clicking “book a call” on an advisor’s website—and how small language and design changes can dramatically improve conversions. You’ll learn practical, compliant fixes including softer CTA language, expectation statements, empathy‑based messaging, simplified design, and reassurance techniques that lower emotional friction. If you want a website that encourages prospects to take the first step confidently, this episode delivers actionable guidance advisors can implement immediately.

How Advisors Can Get 10 Hours Back Every Week

In this episode of The RARE Advisor, host Aaron Grady and USA Financial Pareto coach and Practice Management Consultant Allan Oehrlein dive into time allocation as a core lever for advisory success. They unpack the biggest time drains—email, unsolicited calls, and open-door interruptions—and lay out a practical framework for calendar rebalancing that starts with personal time, management time, client appointments, dedicated communications windows, “work on the business” time, and high-impact growth activities. With real-world stories showing how advisors shift from reactive days to structured weeks (and even reclaim Fridays), Aaron and Allan share easy-to-implement tips: color coding calendars, scheduling buffers, daily huddles, and call/appointment protocols. If you’re ready to audit your calendar, define your ideal week, and create structure that truly liberates your practice, this conversation is your next step.

What Billion-Dollar Brands Teach Advisors About Client Loyalty

In this episode of the Financial Advisor Marketing Playbook, Mark Mersman explores what billion-dollar consumer brands like Peloton, Apple, Airbnb, Disney, and Starbucks understand about loyalty—and how financial advisors can apply these lessons to their own practices. Discover why loyalty is emotional, not transactional, and learn practical strategies to create belonging, simplify your process, showcase identity, design unforgettable experiences, and personalize client interactions. Tune in to transform your value proposition and build a community your clients never want to leave.

The Psychology Behind Your CTA: Why Prospects Don’t Click “Book a Call”

In this episode of Financial Advisor Marketing Playbook, Mark Mersman breaks down the real psychological barriers that stop prospects from clicking “book a call” on an advisor’s website—and how small language and design changes can dramatically improve conversions. You’ll learn practical, compliant fixes including softer CTA language, expectation statements, empathy‑based messaging, simplified design, and reassurance techniques that lower emotional friction. If you want a website that encourages prospects to take the first step confidently, this episode delivers actionable guidance advisors can implement immediately.

How Advisors Can Get 10 Hours Back Every Week

In this episode of The RARE Advisor, host Aaron Grady and USA Financial Pareto coach and Practice Management Consultant Allan Oehrlein dive into time allocation as a core lever for advisory success. They unpack the biggest time drains—email, unsolicited calls, and open-door interruptions—and lay out a practical framework for calendar rebalancing that starts with personal time, management time, client appointments, dedicated communications windows, “work on the business” time, and high-impact growth activities. With real-world stories showing how advisors shift from reactive days to structured weeks (and even reclaim Fridays), Aaron and Allan share easy-to-implement tips: color coding calendars, scheduling buffers, daily huddles, and call/appointment protocols. If you’re ready to audit your calendar, define your ideal week, and create structure that truly liberates your practice, this conversation is your next step.

What Billion-Dollar Brands Teach Advisors About Client Loyalty

In this episode of the Financial Advisor Marketing Playbook, Mark Mersman explores what billion-dollar consumer brands like Peloton, Apple, Airbnb, Disney, and Starbucks understand about loyalty—and how financial advisors can apply these lessons to their own practices. Discover why loyalty is emotional, not transactional, and learn practical strategies to create belonging, simplify your process, showcase identity, design unforgettable experiences, and personalize client interactions. Tune in to transform your value proposition and build a community your clients never want to leave.