The RARE Advisor: Trump Card Portfolio Design

There are certain common themes you can find in the best financial advisors. We see one of them, inside the area of portfolio management, all the time. In this episode of The RARE Advisor, we’ll talk about the trump card to portfolio design and how it affects your practice.

There is a huge philosophical void between active management and passive management when it comes to running portfolios - either for your client by you personally, or the client doing it by themselves. Now, generally speaking, you would assume that there is a lot more passive management taking place out there because of the huge institutions that are really behind the movement of passive management. But, there are probably more active managers out there than there are passive, because you need more people involved to actively manage things. And it tends to be at smaller overall sizes. So in other words, the ETF for the passive tracking of the QQQ for the NASDAQ 100 or for the S&P500, those are just monster size mutual funds and ETFs. The actively managed stuff can be big, too. Obviously, there's exceptions to every rule, but as a total they tend to be a little smaller in size.

Then, there are philosophical changes and differences on what you think. I tend to lean a little more towards active because I want someone monitoring and taking control of the situation; I don't want to just ride and coast through the next financial crisis. And when you're on the passive side, the argument is that active advisors can never time it correctly, and so on and so forth, so you're better off just staying still. So you can fall in whatever camp that you like on that. Now there are times when it moves, which is what we're going to talk about in a moment. After a financial crisis, a lot more money kind of moves towards active. And once things are hunky dory for a long enough period of time, things start going back towards passive - which is what's kind of going on right now. But, what I really want you to think about is risk management. I kind of talked about active management as if it has a risk component (doesn't always), that's what I mean. Really, there's almost a third category - there's risk management. Whether it's passive or active, I want to know if somebody hits the alarm that we can move out of equities, for example, and I can sidestep things like the financial crisis.

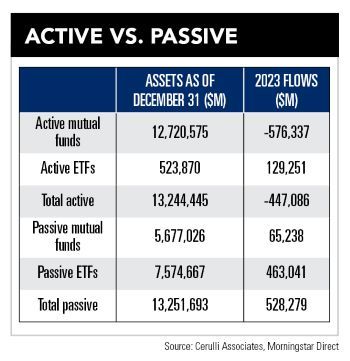

There was a study recently completed from Cerulli Associates looking at Morningstar Direct information. I wanted to share this one simple chart, because I want to show you how close, how neck and neck, this is. This is total active (doesn't matter whether it's funds or ETFs) in millions. So 13 million millions of dollars sitting in active management. Passive management has 13 million millions of dollars sitting there as well. They're almost an identical number. But look at what has happened here in 2023. In 2023, we had a huge negative outflow from active and a huge positive inflow into passive. Again, the markets been doing really well. When the market is doing well, that's what happens.

There was a study recently completed from Cerulli Associates looking at Morningstar Direct information. I wanted to share this one simple chart, because I want to show you how close, how neck and neck, this is. This is total active (doesn't matter whether it's funds or ETFs) in millions. So 13 million millions of dollars sitting in active management. Passive management has 13 million millions of dollars sitting there as well. They're almost an identical number. But look at what has happened here in 2023. In 2023, we had a huge negative outflow from active and a huge positive inflow into passive. Again, the markets been doing really well. When the market is doing well, that's what happens.

So there is a thought that you need to have as a financial advisor, and you need to understand - especially if you tend to lean more towards the passive camp. And that is that when people get sick, that's when the doctors are needed most. Right? When people are healthy, they're not calling their doctor just randomly because they want to chit chat. When people get sick, that's when they go to the doctor. When markets crash, that's when people need financial advisors. That's when people need active management. When the sun is shining, passive is just fine. I'm perfectly healthy. I don't need to go see the doctor. But when things aren't so good, that's when you earn your keep as a financial advisor.

Regardless of whether you want to fall in the active camp or the passive camp, what I will contend is that you need to consider risk management. Whether that risk management is laid atop passive or laid atop active, what you really need to focus on is risk management. Because when people get sick, we want to make sure we have the cure, that we have the proper medicine. So, consider risk management. We run a TAMP program - we've got all kinds of different strategies from all kinds of different asset managers on there. But again, the most popular stuff in there tends to be that which has good risk management.

--

The RARE Advisor is a business model supercharged by Recurring And Repeatable Events. With more than thirty years of working with and coaching successful advisors, host Mike Walters (along with other leaders in the industry), discusses what it takes to grow a successful practice. With the aim of helping financial professionals and financial advisors take their business to the next level, Mike Walters shares insights and success stories that make a real impact. Regardless of the stage of your practice, The RARE Advisor will provide thoughtful guidance, suggestions for developing systems and processes that work, and ideas for creating an authentic experience for your clients.

The RARE Advisor is also a podcast! Subscribe today via Apple Podcasts, Google Podcasts, or your preferred podcast listening service for easier on-the-go listening

Author Info

Mike Walters is the Chief Executive Officer (CEO) of USA Financial, leading the firm since its inception in 1988. Mike is committed to...

Related Posts

How Advisors Can Get 10 Hours Back Every Week

In this episode of The RARE Advisor, host Aaron Grady and USA Financial Pareto coach and Practice Management Consultant Allan Oehrlein dive into time allocation as a core lever for advisory success. They unpack the biggest time drains—email, unsolicited calls, and open-door interruptions—and lay out a practical framework for calendar rebalancing that starts with personal time, management time, client appointments, dedicated communications windows, “work on the business” time, and high-impact growth activities. With real-world stories showing how advisors shift from reactive days to structured weeks (and even reclaim Fridays), Aaron and Allan share easy-to-implement tips: color coding calendars, scheduling buffers, daily huddles, and call/appointment protocols. If you’re ready to audit your calendar, define your ideal week, and create structure that truly liberates your practice, this conversation is your next step.

What Billion-Dollar Brands Teach Advisors About Client Loyalty

In this episode of the Financial Advisor Marketing Playbook, Mark Mersman explores what billion-dollar consumer brands like Peloton, Apple, Airbnb, Disney, and Starbucks understand about loyalty—and how financial advisors can apply these lessons to their own practices. Discover why loyalty is emotional, not transactional, and learn practical strategies to create belonging, simplify your process, showcase identity, design unforgettable experiences, and personalize client interactions. Tune in to transform your value proposition and build a community your clients never want to leave.

Continuity Plans vs. Succession Plans: Why Every Advisory Practice Needs Both

What’s the difference between a continuity plan and a succession plan—and why does your advisory practice need both? In this episode of The Rare Advisor, Aaron Grady breaks down these two essential strategies, explains how they protect your firm from unexpected events and prepare you for long-term success, and shares practical steps to start building or improving your plans. If you want to safeguard your business, elevate your professionalism, and protect your legacy, this episode is a must-watch.

How Advisors Can Get 10 Hours Back Every Week

In this episode of The RARE Advisor, host Aaron Grady and USA Financial Pareto coach and Practice Management Consultant Allan Oehrlein dive into time allocation as a core lever for advisory success. They unpack the biggest time drains—email, unsolicited calls, and open-door interruptions—and lay out a practical framework for calendar rebalancing that starts with personal time, management time, client appointments, dedicated communications windows, “work on the business” time, and high-impact growth activities. With real-world stories showing how advisors shift from reactive days to structured weeks (and even reclaim Fridays), Aaron and Allan share easy-to-implement tips: color coding calendars, scheduling buffers, daily huddles, and call/appointment protocols. If you’re ready to audit your calendar, define your ideal week, and create structure that truly liberates your practice, this conversation is your next step.

What Billion-Dollar Brands Teach Advisors About Client Loyalty

In this episode of the Financial Advisor Marketing Playbook, Mark Mersman explores what billion-dollar consumer brands like Peloton, Apple, Airbnb, Disney, and Starbucks understand about loyalty—and how financial advisors can apply these lessons to their own practices. Discover why loyalty is emotional, not transactional, and learn practical strategies to create belonging, simplify your process, showcase identity, design unforgettable experiences, and personalize client interactions. Tune in to transform your value proposition and build a community your clients never want to leave.

Continuity Plans vs. Succession Plans: Why Every Advisory Practice Needs Both

What’s the difference between a continuity plan and a succession plan—and why does your advisory practice need both? In this episode of The Rare Advisor, Aaron Grady breaks down these two essential strategies, explains how they protect your firm from unexpected events and prepare you for long-term success, and shares practical steps to start building or improving your plans. If you want to safeguard your business, elevate your professionalism, and protect your legacy, this episode is a must-watch.