Build your business and get more time back in your day. Meet PortfolioHQ.

Our all-inclusive platform streamlines wealth management by bringing together the tools you need to provide efficiencies for your business and deliver a better client experience.

You can easily manage portfolios to tailor and analyze risk, all while unifying your client’s data from all sources to build better client reports. PortfolioHQ is more than portfolio management software. It's your digital back office with enhanced trade execution tools, simplified forms, and so much more.

Your practice, your way: Empowering you with options.

We offer the flexibility of two paths for investment management that can either be used independently or alongside each other. This varies based on how your practice is structured and how you like to work.

Advisor Integrated Management*

This path puts you in the driver seat. Create scale for your trading operations quickly and efficiently with strategy implementation, management, trading, rebalancing, and overlay management.

Advisor as Primary Manager

With this path, each client portfolio is managed uniquely. An Advisor as Primary Manager (APM) account allows you to “de-sleeve” an portfolio, which may be desired to preserve legacy holdings, address unique tax scenarios, or provide a completely customized portfolio.

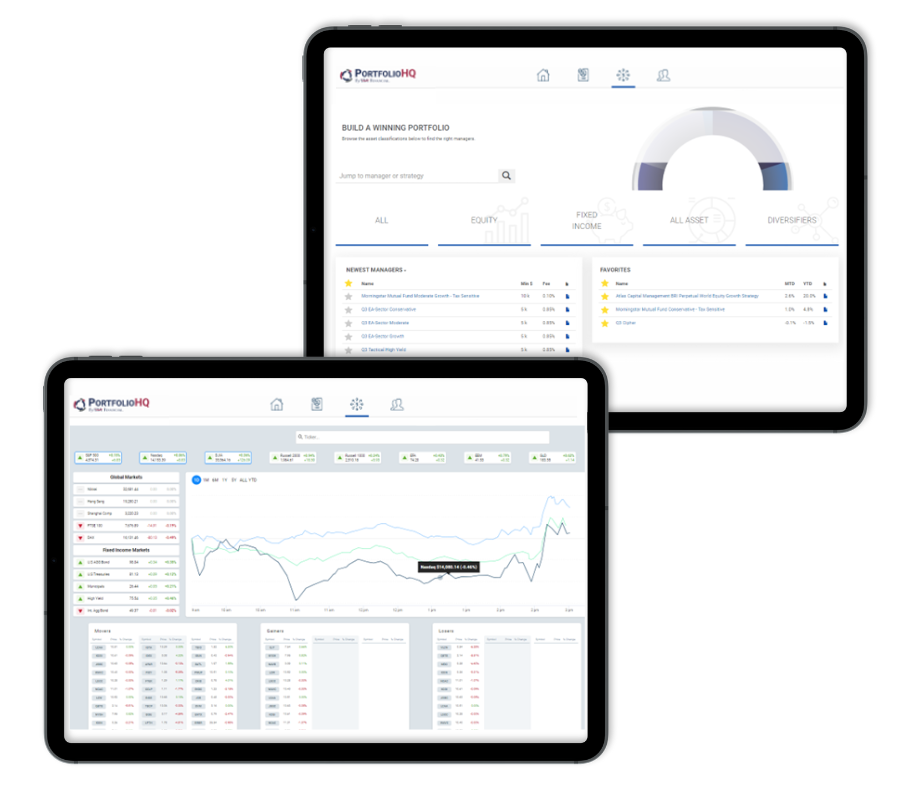

Strategy Select Management

Choose the third-party investment manager(s) and strategies to design the ideal portfolio for your clients. Effortlessly provide separately managed account (SMA) and unified managed account (UMA) portfolios to your clients. Rather than selecting one investment manager, this allows you to diversify and customize a client’s portfolio to their unique set of goals while managing it seamlessly in one location. In short, this platform is flexible and provides customized wealth management solutions which is better for the client and you.

*Subject to qualification and platform approval.

Take advantage of all the ways you can do more with the technological capabilities offered by PortfolioHQ.

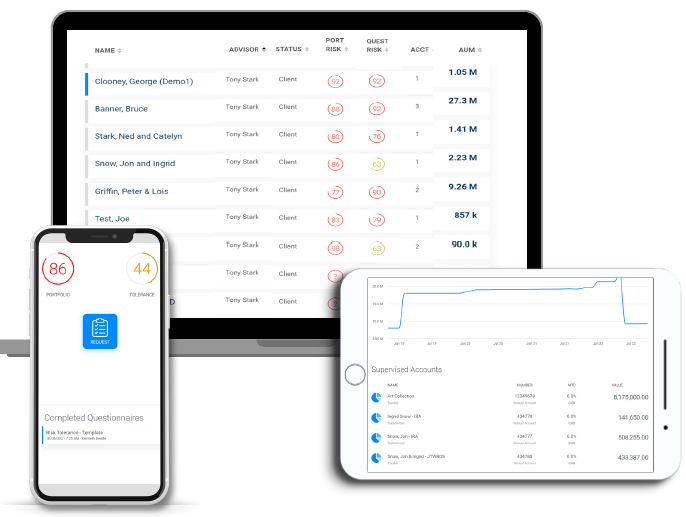

Risk Analysis

Every client has different goals and objectives for long term investing. So, when it comes to planning out a prospective client’s portfolio you typically start with evaluating their risk tolerance. The platform allows you to track past and current client risk answers to stay ahead of compliance.

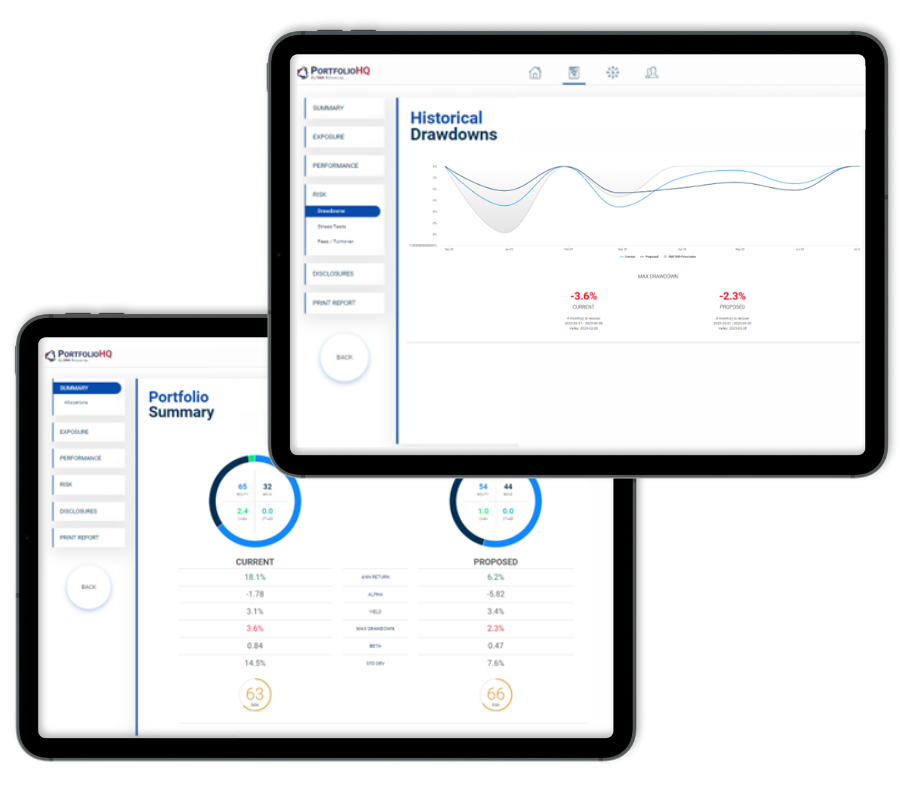

Portfolio Analysis

Use the Analyzer tool to objectively review and compare portfolios across a wide range of attributes like exposure breakdowns, expenses, risk factors, and much more. It’s as easy as:

- Uploading their current portfolio in seconds.

- Evaluating that portfolio with your recommendations.

- Sharing the 100% customizable presentation to help you demonstrate the value of your recommendations.

With just a few clicks, you can upload their current portfolio and compare it side-by-side with your recommendations.

Strategy & Market Research

Evaluate market sectors, performance, trends, create a watchlist, or look up specific strategies that may fit your client’s needs. You can do all of this within your PortfolioHQ dashboard so there’s no need to go out to multiple online sources to find the information you’re looking for when it’s all in one spot to help you build a solid portfolio for your client.

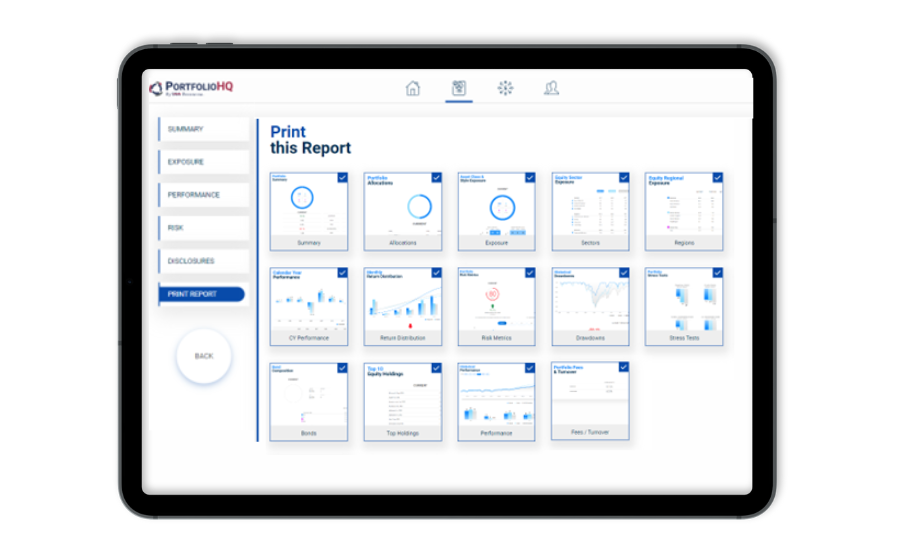

Proposal Generation

Choose what you want to share the proposed portfolio with your client. The report feature within the proposed portfolio summary will allow you to select the pages you’d like included in the report and skip the ones you don’t want. These pages could include the summary, allocations, exposure, top holdings, drawdowns, fees, and more. This will allow you to share what’s most valuable to the client as part of your meeting to review.

Digital Back Office

In addition to providing the essential digital forms and signatures, this portfolio management platform also enhances the experiences of employees, advisors, and clients.

Paperless Process

Enter data once, and it automatically populates multiples forms—eliminates rekeying and reducing NIGOs.

Custodian-Sensitive Pathways

Support different custodians with intelligent workflows—such as onboarding processes that adapt to each custodian’s account opening procedures.

Intelligent Workflows

Automate, and reduce low-value activity across the value chain –to drive not only growth and profitability as a business, but improved client outcomes through more personalized service.

Billing & Revenue Management

Bring clarity to your billing and revenue management and streamline your workflows.

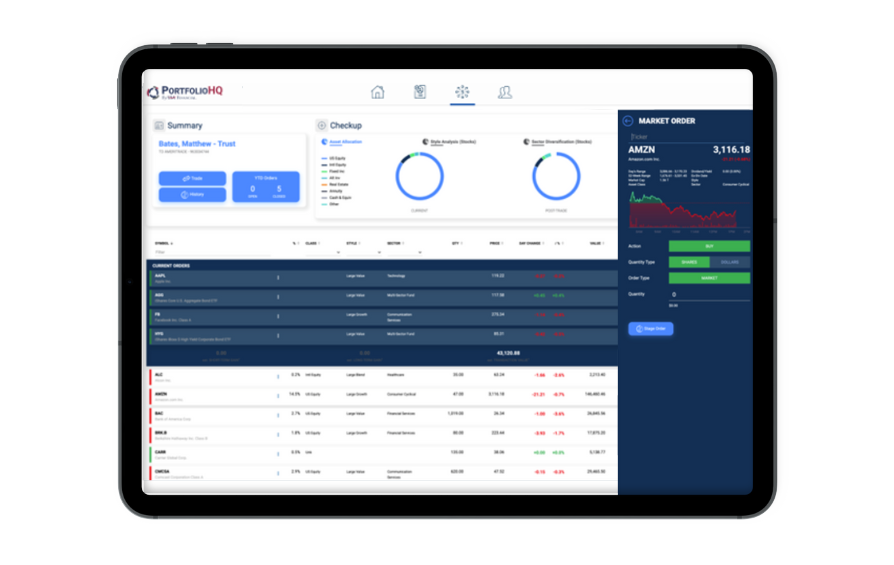

Trading & Rebalancing

PortfolioHQ's intelligent trading and rebalancing system centralizes your trading in a single, multi-asset application, giving you clarity and control over your portfolios and models.

- Simple - Whether active, passive or somewhere in between, seamlessly facilitate trading and rebalancing at the account and sleeve level.

- Sophisticated - Identify outlying accounts conditions such as portfolios and models drifting outside target allocations, holding too little cash or making tactical trades.

- Efficient - Dramatically shortens the trading process while staying true to your investment strategies, account settings, and restrictions.

- Scalable - Reduce the administrative burden of managing multiple clients.

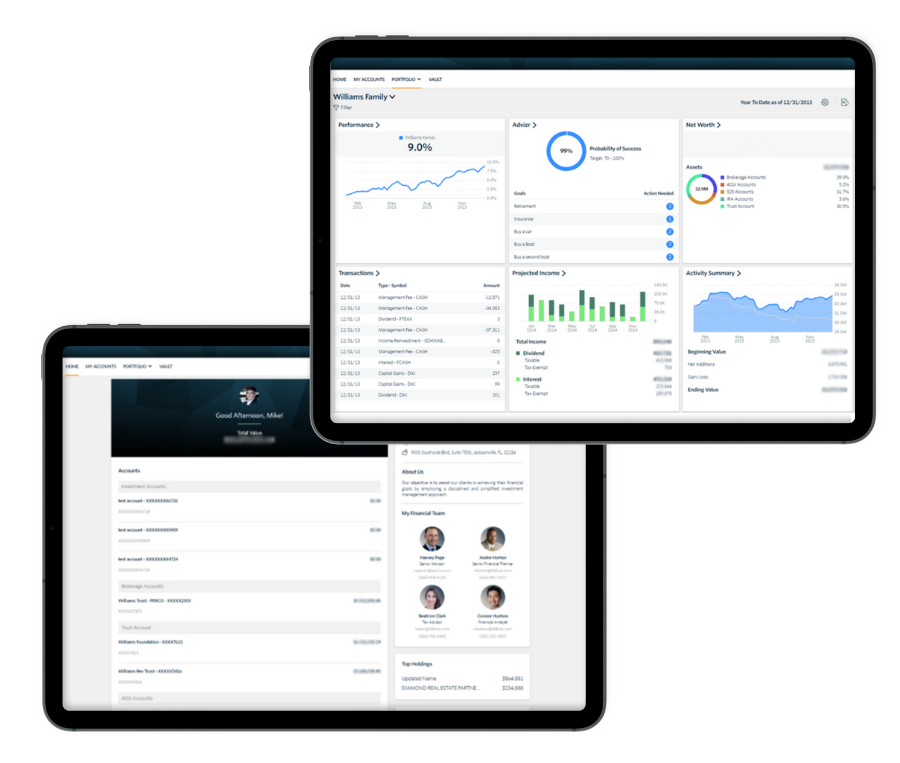

Integrated Client Portal & Vault

Personalization and convenience are now standard expectations for today's clients. They expect to have on-demand access to their personal financial information and a high-quality, personalized experience that is on par with other online services.

Practice Management +

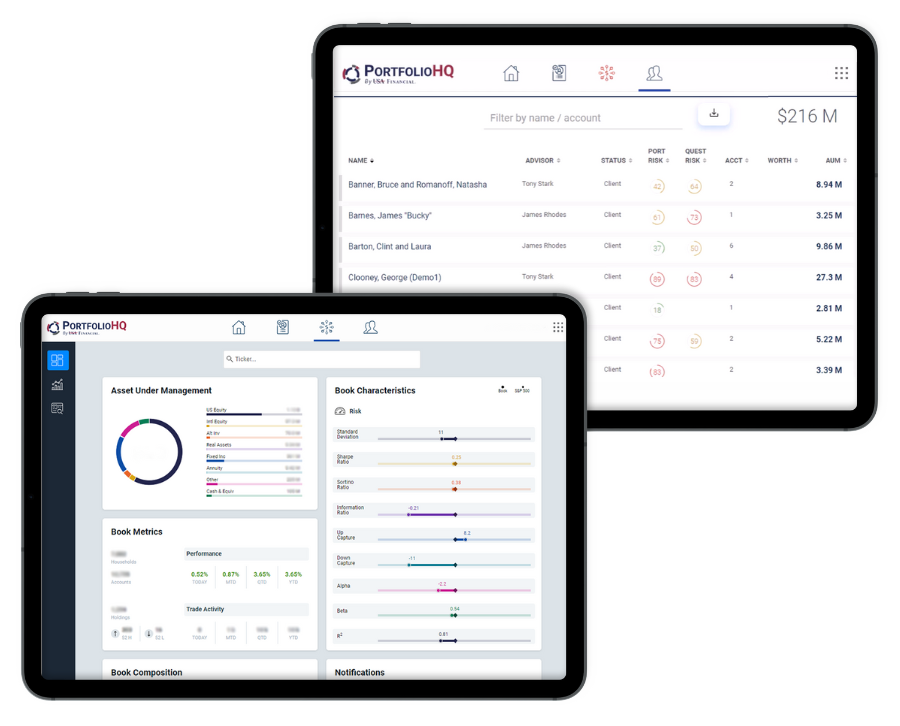

Household Management & Reporting

Effectively manage your book of business with key analytics and oversight at the household level, account level, and individual positions within a single dashboard. You’ll be able to review book level performance, trading data, composition, and risk as well as see account and holding position specific data points. This level of detail can help you easily manage and plan for conversations with your clients. The dashboard also provides you with the ability to create custom client facing reports for upcoming client meetings or when they’ve requested it, create the report, and auto send it to their client portal. The auto send reports can be sent when needed or on a quarterly, semi-annual, or annual basis.