The RARE Advisor: Adding Tangibility to an Intangible Industry

One of the most difficult tasks that financial advisors have is creating tangible value out of this intangible industry. Most of your customers, investors, and prospective customers need to be able to wrap their mind around something more tangible, and we’ll share how to fix that problem in this episode of The RARE Advisor.

Before we jump into the primary subject, I want to share with you something I'm really excited about: we have a new report called the 'Advisor's 12-Step Reset for Predictable Growth, Value & Lifestyle'. It's a smooth, 12-step process that I've uncovered and discovered over my 35+ year journey in this industry. And it's designed to generate a predictable practice with automated revenue and lifetime rewards.

With that being said, I want to talk to you about adding, or creating, tangibility in your intangible practice. We're in an intangible industry, we all know that, and it's one of the things that makes it so difficult. People have a hard time wrapping their mind around the intangible. And so we've learned long, long ago that the more tangibility that we can create in this intangible environment, the higher our success factors will be - regardless of what you're measuring them as. Whether you're measuring them as revenue, or new clients onboarding, or assets gathered, or volume of AUM. All of those things are entirely dependent upon your ability to add tangibility to an intangible environment. And one of the quickest ways to do that is to establish systems and processes in your business - what I like to call pushing buttons and flipping levers. If I can push buttons and flip levers (whether it's a way to drive new clients to the firm, or a part of our financial planning process, or how we induce a certain assessment on on a segment of someone's financial life) and know that this kind of assembly line response will happen based on that - all of these things can have a workflow attached to them (a system and a process), and they can be properly named to bring them to life. In doing so, you add tangibility, you allow people who probably operate in a much more tangible job and environment than you do to make analogies for themselves, wrap their mind around it, and have something to adhere to. So it's super, super important.

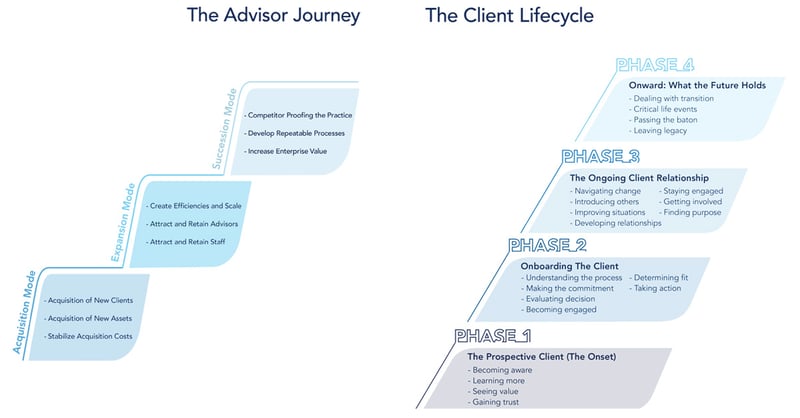

Here's a quick example of two ways to bring a process or a system to life. Obviously naming it is important. We'll start with the Advisor Journey. I just want to show you the idea of how we're visually bringing this to life. So the Advisor Journey, if you're new to the industry or starting your own practice, you have to start down at the Acquisition Mode. And we're not talking about acquisition in terms of purchasing the practice. We're talking about acquiring new clients, acquiring new assets, and being able to stabilize your acquisition costs so that you have something that's predictable. You know what your return on investment will be by investing in the systems and tools needed to generate new clientele and how that will kind of play out in the life of your practice. And then from there, you work your way up into Expansion Mode, and then ultimately into Succession Mode. Now oftentimes, once you're established and up and running, you might even be operating in two of these areas at once. Once in a blue moon, we'll see someone truly operating in all three. But normally, you'd kind of settle into two. And that's the stage of life that you're at in the Advisor Journey. But the point is, once I have this conversation with someone and share this with them, we can talk about exactly what the Advisor Journey is, and which mode they're in. And they will have a better understanding.

You can do something similar with The Client Lifecycle. We have four phases of the client lifecycle: it starts with the Prospective Client (the Onset), and then it moves to Onboarding the Client, then the Ongoing Relationship, and then what we call Onward and Upward (what the future holds in terms of how it's going to live out through their legacy). And you can literally share something like this with a client so that they can understand what phase they're in. It just tends to bring things to life.

Now a way to figure out how you're doing in this world, or where you need to start (if you're starting from scratch), is by taking a Practice Management Index test. It's a multiple choice test that will take you maybe 10-15 minutes to do based on your practice, and you're going to get three main things out of this: you're going to get an overall score, then a score on the six core practice management pillars, and then inside of the pillars you'll receive a score on business focus areas. It's going to give you an idea of where you're doing well and where you need to work on. In an example of an advisor we worked with, they scored high on client management, key performance indicators, and client information. But at the bottom of the list, it shows that they're not doing well around strategic planning and dealing with ideal clients. And they're really losing it at systems and processes, which happens to be the subject we're talking about here today to create tangibility. So in other words, this individual is probably running a pretty good practice, but they're not doing it as as efficiently as they can because they don't have proper systems and processes in place. And that does two things: it doesn't allow your staff to streamline itself, and it doesn't allow you to bring tangibility into the client conversation. By the way, adding tangibility will also help with your staff, especially if they're relatively new to the financial services industry.

So again, pretty cool stuff. Think in terms of how you can add tangibility to your practice. You want to be able to push buttons and flip levers and have predictable outcomes. And again, if you love this stuff the way I do, go ahead and take a look at the 'Advisor's 12-Step Reset' report. It's over 30 pages of really deep-dive golden nuggets to help you run a better practice.

--

The RARE Advisor is a business model supercharged by Recurring And Repeatable Events. With more than thirty years of working with and coaching successful advisors, host Mike Walters (along with other leaders in the industry), discusses what it takes to grow a successful practice. With the aim of helping financial professionals and financial advisors take their business to the next level, Mike Walters shares insights and success stories that make a real impact. Regardless of the stage of your practice, The RARE Advisor will provide thoughtful guidance, suggestions for developing systems and processes that work, and ideas for creating an authentic experience for your clients.

The RARE Advisor is also a podcast! Subscribe today via Apple Podcasts, Google Podcasts, or your preferred podcast listening service for easier on-the-go listening.

Author Info

Mike Walters is the Chief Executive Officer (CEO) of USA Financial, leading the firm since its inception in 1988. Mike is committed to...

Related Posts

Continuity Plans vs. Succession Plans: Why Every Advisory Practice Needs Both

What’s the difference between a continuity plan and a succession plan—and why does your advisory practice need both? In this episode of The Rare Advisor, Aaron Grady breaks down these two essential strategies, explains how they protect your firm from unexpected events and prepare you for long-term success, and shares practical steps to start building or improving your plans. If you want to safeguard your business, elevate your professionalism, and protect your legacy, this episode is a must-watch.

Behavioral Finance, Simplified: 5 Biases Advisors Must Use in Their Marketing

In this episode of Financial Advisor’s Marketing Playbook, host Mark Mersman breaks down five core behavioral biases—loss aversion, status quo bias, anchoring, choice overload, and social proof—and shows how each can be translated into clear, compliant marketing messages that resonate with real human decision-making. You’ll learn how to reduce cognitive load, make emotion visible, eliminate friction, and set deliberate anchors in your website copy, emails, seminars, and first meetings. If you want your marketing to reflect how clients actually think and choose advisors, this practical framework will help you shift from a purely logical approach to one that validates emotions first—and earns trust that clients can later justify with facts.

Mastering the Service Matrix: Elevate Client Experience & Drive Advocacy

In this episode of The Rare Advisor, Aaron Grady and Allan Oehrlein dive deep into two essential tools for modern advisory practices: the service matrix and the stewardship framework. Discover why moving from a reactive to a proactive service model is critical for consistency, scalability, and client advocacy. Learn how these frameworks help advisors deliver predictable, high-touch experiences, segment clients effectively, and create professional contrast that sets your firm apart. If you want to elevate your client experience and build loyalty that lasts, this conversation is packed with actionable insights.

Continuity Plans vs. Succession Plans: Why Every Advisory Practice Needs Both

What’s the difference between a continuity plan and a succession plan—and why does your advisory practice need both? In this episode of The Rare Advisor, Aaron Grady breaks down these two essential strategies, explains how they protect your firm from unexpected events and prepare you for long-term success, and shares practical steps to start building or improving your plans. If you want to safeguard your business, elevate your professionalism, and protect your legacy, this episode is a must-watch.

Behavioral Finance, Simplified: 5 Biases Advisors Must Use in Their Marketing

In this episode of Financial Advisor’s Marketing Playbook, host Mark Mersman breaks down five core behavioral biases—loss aversion, status quo bias, anchoring, choice overload, and social proof—and shows how each can be translated into clear, compliant marketing messages that resonate with real human decision-making. You’ll learn how to reduce cognitive load, make emotion visible, eliminate friction, and set deliberate anchors in your website copy, emails, seminars, and first meetings. If you want your marketing to reflect how clients actually think and choose advisors, this practical framework will help you shift from a purely logical approach to one that validates emotions first—and earns trust that clients can later justify with facts.

Mastering the Service Matrix: Elevate Client Experience & Drive Advocacy

In this episode of The Rare Advisor, Aaron Grady and Allan Oehrlein dive deep into two essential tools for modern advisory practices: the service matrix and the stewardship framework. Discover why moving from a reactive to a proactive service model is critical for consistency, scalability, and client advocacy. Learn how these frameworks help advisors deliver predictable, high-touch experiences, segment clients effectively, and create professional contrast that sets your firm apart. If you want to elevate your client experience and build loyalty that lasts, this conversation is packed with actionable insights.